Happy New Year

HAPPY NEW YEAR |

WILL THE RABBIT BOUNCE?

Being predominantly a buy side advisor we are quite excited about 2023. This is very much a timing issue with a focus on late 2024 onwards. Our expectations for the year do not discount the many serious challenges being faced but, barring significant shocks, we are expecting continued weakness in sterling, a shallow recession, followed by a cyclical recovery which will actually be boosted by a change of Government next year.

It is a measure of the mess our politicians have made in recent years that a Labour government is being cautiously anticipated across the political divide. Recently we have had an ex-Tory minister from Thersea May’s time (remember her?) laud Keir Starmer and Tory grandee Ken Clark saying the Tories need a period of opposition to reset. The Tories in their tired desperation, and lack of vision, have stolen many of Labour’s clothes in recent years and Labour in turn have moderated many of their views from taxation through to the culture wars. The consequence being that whichever party is in power, there is very limited wiggle room on raising taxes and cutting costs. Meanwhile the business community is actively courting Keir Starmer and his team as they too recognise a change may well be for the good.

We are no economic forcasters but based on commentary we expect to see inflation fall back to around 3-4% by mid 2024. Still above the official BOE 2% target, but a bit of inflation is property’s friend. Base rates, which had been predicted to hit 6.5%, now look likely to peak closer to 4.5% and be back to the current mid 3’s by end of 2024. On a macro level, the Ukraine war will (inshallah) have been resolved, leaving neither side happy, and the aggresor dangerous as it counts the cost, and licks its wounds. China and the USA will put aside some of their long term statageic goals as both look to rebuild their economies, albeit less dependent on each other than the pre Covid era. In short a world that starts to look like normal?

The UK property market is not one single entity although so often talked as if one. There are many distinct sectors and numerous sub sectors but in order to focus on the market we operate in, we tend to divide this between the Prime (international) London market and the rest.

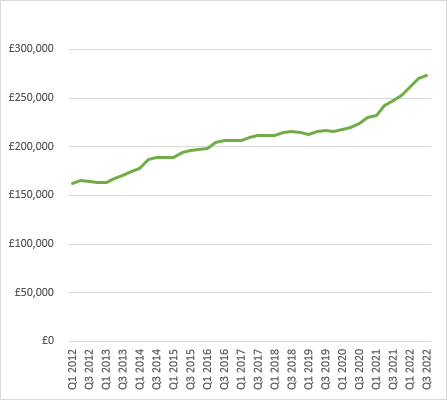

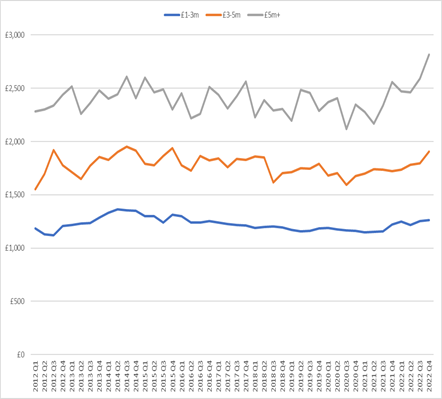

The domestic housing market (average price circa £285k) has enjoyed uninterrupted year on year growth for a decade, wheras the prime central London market has seen significant volatility over the past decade. Using data provided by Lonres the performance varies significantly when dividing the market into distinct price brackets. The following graph shows the PCL market over the past decade broken down in to three price categories and then compared with Nationwide’s national house price index.

|

PCL Market

|

Nationwide house price index

|

| Some numbers extrapolated; | |||

| Peak to trough 2014/2015 to 2018/19 |

Recovery 2018/2019 to 2022 |

Adjusted 2014-2022 |

|

| £1-3m | -14.9% | 9.1% | -7.15% |

| £3-5m | -17% | 17.8% | -2.25% |

| £5m plus | -15.9% | 28.2% | 7.8% |

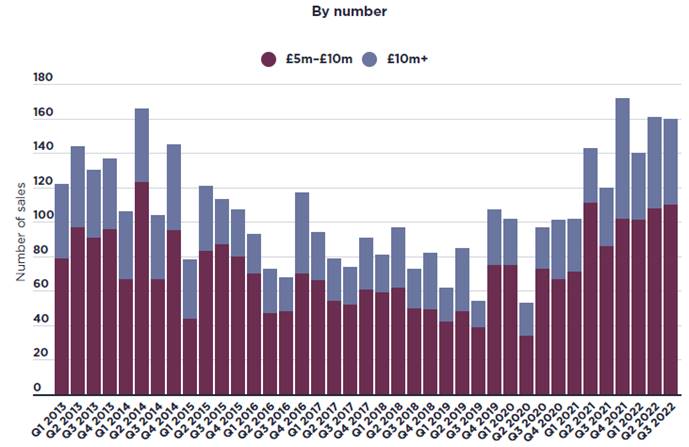

Sales at the £5m plus price point were up 63% last year compared with the 2017-2019 pre-pandemic average

By contrast, The £1m to £2m market saw 23% more sales in 2022 than the 2017-2019 average, while the £2m to £5m market recorded a 42% rise over the same period.

So at the lower end, buyers have seen a decade of effective price stagnation, however that market remained reasonably liquid and, for the investor, the close to 20% jump in rents last year has been welcome. The very top end saw transactions drop off a cliff and red book valuations plummet far further than the above statistics imply, as mentioned. However, the recovery at the very top end has been clear to see over the past 6-12 months and the pull effect is making itself felt as you go down the pricing scale.

What is important to highlight however is the absence, in the Lonres data, of new build sales. Actual real time data on new build sales is as transparent as Vladimir Putin’s bank statements. New build commands big premiums and 2nd, 3rd phases very often depress values of previous phases. Rents usually disappoint due to competition from other landlords coming on stream all at a similar time, and typical buyers of new build prefer new build to secondary new build.

PAIN OF NEW BUILD PREMIUMS

We never have been a fan of buying brand new. At a minimum a new build, like a new car, will command a 10% premium which evaporates as soon as the new owner picks up the key. Some will argue that a new build guarantees piece of mind, but we can bore you with examples where very high end schemes have had major issues. One has had all the bathrooms in the entire scheme replaced, and another accumulated £700k in legal fees to sue the main contractor for dodgy windows.

However, there is clear merit in buying secondhand ‘new build’ and here are few recent examples;

Here are a few of representative examples;

Islington (942 sq ft)

Original purchase from developer £1.3m 2016

Acquired by Obbard @ £1.15m in 2022

Earls Court (978 sq ft)

Original purchase from developer £1.41m in 2017

Acquired by Obbard @ £1.3m in 2022

Holland Park (2,196sq ft)

Original purchase from developer £5.965m 2013

Acquired by Obbard @ £5.64m in Nov 2021

THE ‘VALUE ADD’ ANGLE RETURNS

We have always preferred to seek out value add opportunities where possible, and those clients who recognise the advantages these bring. With in/out costs of buying/selling anything from 10-20%, the ability to mitigate this is appealing the say the least. Then there is the advantage of having a property designed and specified to your own needs, personality and tastes.

In the past, I used to highlight buying opportunity in these commentaries. For some time now I have been circumspect on the reality of achieving sufficient added value. Today I do feel there is a change in the air. However, the punitive transaction costs (stamp duty in the main) mean short term realisable profits are a tall ask.

The ability to buy well and add value becomes critical if one is looking to achieve genuine capital upside. Those statistics above all exclude transaction costs. This has always been our approach and its why we have morphed in to a buying agent cum build/design company.

Most of today’s buyers are significantly put off buying property in need of refurbishment, for many reasons not least spiraling costs this past year, but there lies the opportunity.

EXAMPLES

Notting Hill , W11 (£1.3m)

A totally unmodernised (1,400 sq ft) 2 bed flat with 54 foot garden on a premier street in Notting Hill. Estimated refurb cost £350k, end value £1.85m.

Kensington, W8 (£3.25m)

In one of Kensington’s grandest period blocks, this top floor 1,816 sq ft apartment with far reaching views is a probate sale. It is totally unmodernised. The guide price is £3.25m and the cost to refurbish £850k.

We completed the sale of the identical flat one floor below just before Christmas. This had been fully refurbished and we achieved £4.65m.

Belgravia, SW1 (£4.25m)

A very large (2,767 sq ft) triplex on Eaton Place. Having first come to the market at an over ambitious £5.4m in 2021, the price was reduced bit by bit. The asking price is currently £4.75m but the seller is now extremely motivated. A target price of £4.25m would make this purchase @ £1,535psf a cracking deal. Refurbishment costs circa £750k. Projected end value, £5.75m Recent comparable sales have average £2,200psf against our conservative target end value @ £2,080psf

Notting Hill, W2 (£6.75m)

Two FH buildings divided in to 10 units. Currently producing circa £250k pa but great scope to improve income. A specific advantage of buying blocks of 6 units or more is the reduced commercial rate of stamp duty, and the merits to own within a corporate entity with loan interest off settable etc.

OUR NEWS

After a three-year hiatus due to COVID I am at last returning to Hong Kong and Singapore next week. In the past these visits have been invaluable to see some old friends, make some new friends and hopefully a future client or two. If you would like a chat then do get in touch, I will be in Hong Kong from 4th to 10th February and in Singapore from 12th to 16th February.

Finally, we are so proud of the response and feedback on our client’s Berry Bros & Rudd St James’s project as we feel we have genuinely delivered something fresh and original to the London market:

“London’s most stylish new address” says House and Garden 2022

“Drink in the views of St James’s Palace…” says Prime Resi 2023

“Seven trends you will want to use in 2023” says The Telegraph 2023

“Truly unique central London rental proposition” says Evening Standard 2022

“Star of St James” says Abode Magazine 2023

“The Hottest Property in Town” says The Mayfair Times 2023

Further information

For more details about No. 1 St James’s Street and other projects, contact Hugh, Patti or Jonny on

+44 (0)20 7349 8920 or email info@obbard.co.uk

| NOTE: The opinions expressed are solely those of the author and are not intended to offer any advice, formal or otherwise, on the nature of property investment. All the information is provided in good faith for general interest only. Recipients who have not formally appointed Obbard are advised to seek independent professional advice and to satisfy themselves on the state of the market, the opportunities and risks. |