Strength in adversity

NEWSLETTER AUTUMN 2020 |

|

Strength in adversity Write off the UK property market at your peril, or so it appears.

|

||||

What the press is saying…

Here are some of the highlights featured in the property press in recent weeks:

‘Rule book rewritten as buyers go on a £37bn summer spending spree,’ according to property portal Rightmove. ‘There is normally a seasonal slowdown in housing market activity over the summer months but not this year.’

House prices ‘are set to hold firm for the remainder of the year,’ predicts Zoopla, despite the onset of a recession and rising unemployment. The portal is standing by its forecast that prices will end 2020 2% or 3% higher than they started it.

Resi developer London Square has cheered the best sales performance in its ten-year history, with revenues, completions and profits all up on 2019. Reporting its latest set of annual results, the large-scale operator confirmed it had completed on 559 homes in the 12-month period, up from 253.

Developer Native Land has reported an encouraging flurry of sales across its portfolio of prime resi schemes, including significant deals in Kensington and Mayfair. The London-based firm has managed to sell a total of 38 units across four projects in prime central London.

Demand from Chinese buyers for UK property tanked between April and June, as the Coronavirus swept the globe. But things have bounced back dramatically in the last month, according to data from Chinese property portal Juwai. In July, Chinese buyers made 213% more enquiries on British property.

Knight Frank has reported exchanging on £100m worth of London property in a single week, as the market continues to defy gravity. The impressive tally – which included both new-build and second-hand sales – was reached in the week ending 7th August, following reports of heightened activity.

The first three quarters of this year have been a true roller coaster for the property market. Having started off in a wave of optimism (it’s easy to forget that sense of relief/release following the December election) the market then entered a period of fear and trepidation as we went in to our own lockdown in late March, only to come sprinting out of the blocks in June/July as lockdown eased. The momentum appears to be continuing but few are not wary of what lies ahead.

What lies ahead

There is no hiding the fact that more challenging times are heading towards us. Some harsh economic truths are expected to be revealed when the likes of the furlough scheme end in a few weeks’ time. Signs of the much anticipated second wave of Covid appear to be showing up in many parts of the world, although mercifully hospital admissions, let alone deaths, are dramatically down on the earlier phase. Brexit is back in the headlines. Political uncertainty elsewhere is prevalent, not least with the US elections.

From a property perspective, we are entering this period with the domestic housing market at an all-time high and the house price to earnings ratio hitting in excess of 10 times in parts of the country. Certainly, the broad domestic market looks extremely vulnerable as the effects of a shrinking economy and rising unemployment begin to bite. While interest rates are still likely to remain at these extreme lows, access to funding is already starting to look like getting harder. Just recently NatWest and Barclays announced a reduction on the income multiple applied on mortgage applications. Last month Nationwide reduced the cash contribution from friends and family (otherwise known as the bank of Mum and Dad) as they looked to ensure borrowers can demonstrate their ability to save. Whilst it is understandable to focus on pricing levels, I suspect just as big a story will be a significant fall in transaction volumes in the next few years. This will likely mirror the experience of the prime markets which saw volumes fall steeply after hitting a high in 2014.

Prime central London has had a meaningful pricing adjustment, albeit coming off from a lengthy period of much sharper growth, and sits at around 20% off its peak of late 2014. Appetite from overseas buyers remains strong, but frustrated by restrictions on international travel and ever-changing quarantine rules. Sterling remains a weak currency and despite significantly increased property taxes, the UK sits in the middle of a global table of combined costs to buy, own and sell residential property.

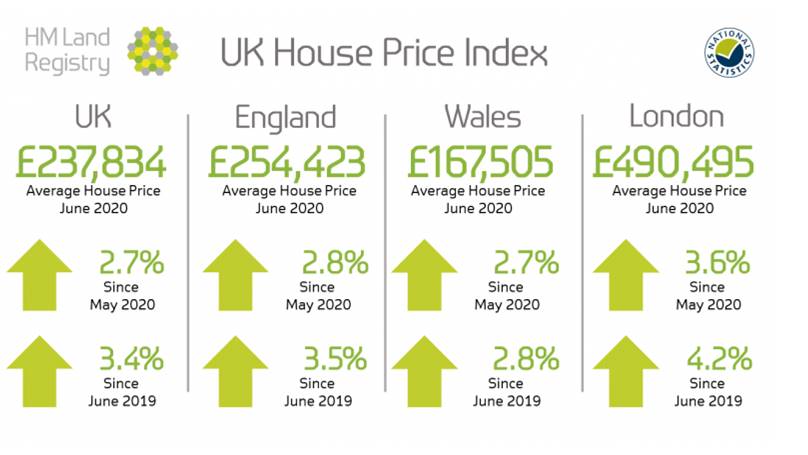

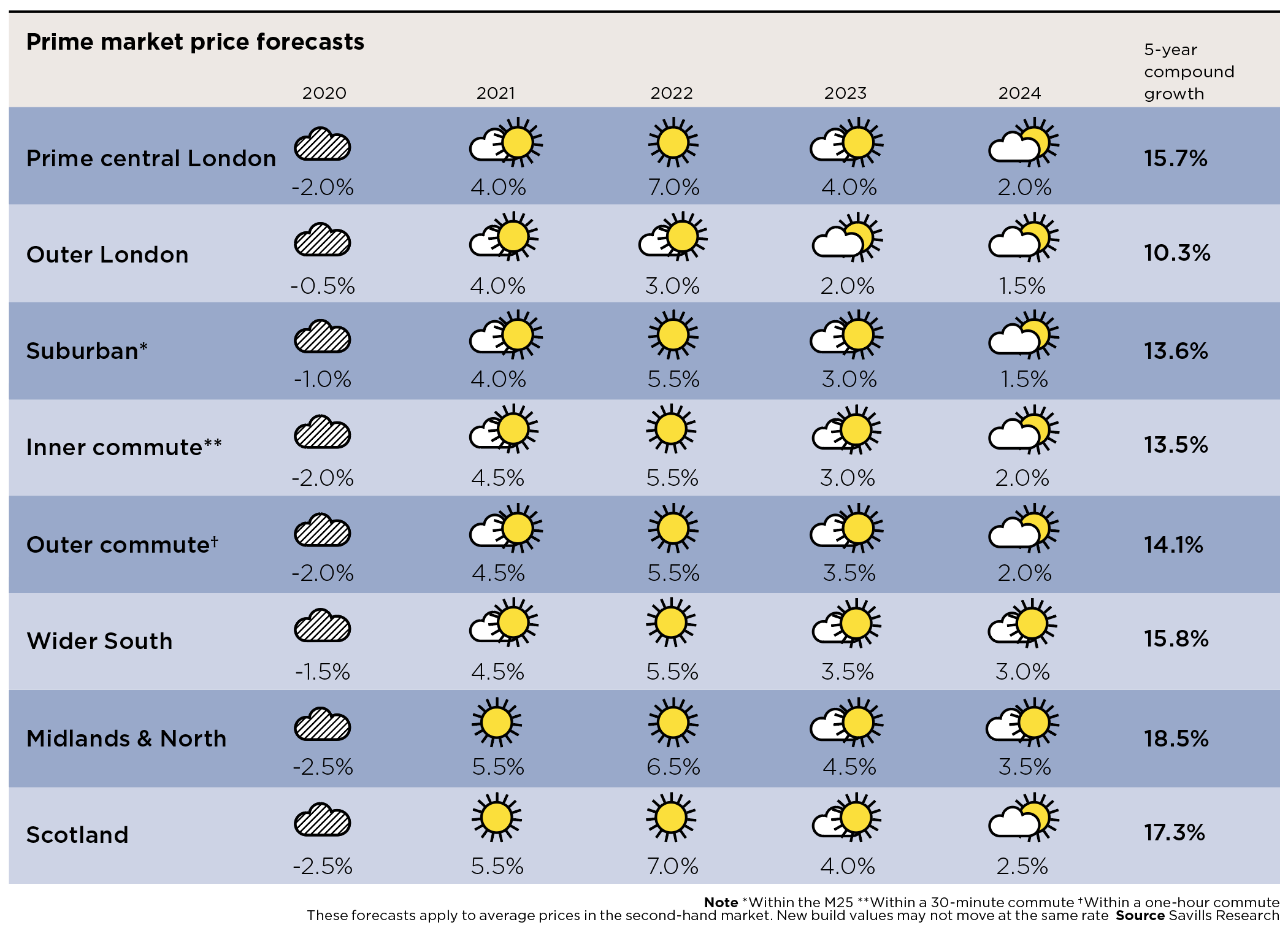

Savills property weather forecast (above) has a generally positive outlook when it comes to the prime markets. For context, the boroughs of RBKC and Westminster have average price values circa £1.3m, as opposed to £235k for the UK as a whole. Although prime central London has seen mortgage funding play a bigger role in recent years, LTVs (loan-to-value) are relatively modest and much of the borrowing was driven by availability of cheap funding as opposed to a fundamental necessity. The government has introduced various stimulus measures for the domestic market, from ‘help to buy’ to a stamp duty holiday, and these are likely either to end or reduce. I suspect therefore that the domestic market will likely see price falls over the next few years and this will be in contrast to a more positive performance for the prime market.

Is the bedroom the new office?

This debate is raging. Some big names like Schroders have announced a permanent end for their employees being office based full time. More and more companies seem to be making similar announcements. If there is one thing the British revere, it’s the sun. Having had one of the hottest springs and summers and the longest period of uninterrupted sunshine on record, it’s no surprise perhaps that just 34% of white collar workers have returned to work. This compares to 83% in France, 76% in Germany, and 68% in Italy.

My guess is that the UK will catch up with the rest of Europe in the weeks/months ahead. As business gets more challenging and the days get shorter, the home appeal may start to wane and many might just put on the suit and get back to the commute either voluntarily or by direction. The legitimate health concerns remain but if a vaccine is produced, or the death rate and severity of the disease reduces dramatically, as it might have started to do, the ability of bosses to expect and require more office attendance will surely rise.

When discussing the very genuine appeal of working a flexi week and creating that idyllic work life balance, it strikes me just how many expect they can be the ones to take Mondays and Fridays off!!

OUR NEWS |

|

Starting… Here are just some examples of what we are up to: St James’s – block of flats for investment We are about to start a major refurbishment of all the apartments in this striking building in St James’s – see photo below. Having totally refurbished a smaller building nearby, owned by the same client, we are now about to start on its much larger neighbour. Kensington – house for family use The design and specification phase has just started on this 3,500 sq ft house. A terrific project to get our teeth into. Kensington – apartment for resale Work will be underway soon on a complete refurbishment of a three-bedroom flat in an attractive and well-regarded mansion block in Kensington.

…Finished South Kensington – house for family use A charming period house in South Kensington completed. This project started just before lockdown but the project timeframe only slightly impacted. Chelsea – apartment for resale The second major refurbishment of this terrific flat near Sloane Square – see photo below. Bought for our client in 2001 and refurbished at that time, we then had a great run with one tenant staying for 11 years. Our client decided it was time to sell and so we brought the flat fully up-to-date and have now launched it on the market for sale. Notting Hill – apartment for pied-a-terre This was one of a couple of flats owned by a client that were bought around 20 years ago. Put on the market for sale, the buyer asked Obespoke, our design wing, to carry out a complete refurbishment, post purchase, in line with the ideas they had seen on our Houzz profile and website.

Bought Barnes A lovely house in a quiet cul-de-sac right by Barnes pond. Bought for a Singapore based client’s mother for retirement and to be remodelled by us for her specific long-term use. South Kensington A perfect pied-a-terre within an attractive white stucco mansion block and a short walk from South Ken’s heart. The seller was under some pressure and the price reflected this. The wonders of a video walk-through enabled our Hong Kong based clients to make a quick decision to snap this up. Belgravia A great three-bed apartment in a portered block with a terrace, parking, long lease, reasonable outgoings, to name a few. A real box ticker!

Design comment Summer 2020 was the year that everyone wanted air conditioning. We had seen a demand growing years back and have been recommending this be included in our refurbishments, wherever possible, as it was clearly a real ‘value adder’. Planning rules and conservation restrictions make this very tricky but often there are still ways to achieve this. |

You can see some of our latest design and build projects at www.obespoke.co.uk

If you would like more information,

do get in touch on +44 (0)20 7349 8920 info@obbard.co.uk

| NOTE: The opinions expressed are solely those of the author and are not intended to offer any advice, formal or otherwise, on the nature of property investment. All the information is provided in good faith for general interest only. Recipients who have not formally appointed Obbard are advised to seek independent professional advice and to satisfy themselves on the state of the market, the opportunities and risks. |