Strange market update

NEWSLETTER SPRING 2020 |

|

‘Strange’ market update These are indeed strange, if not scary, times. The papers and news bulletins offer up an endless menu of depressing statistics and heart-breaking stories. A macabre league table of deaths by country and cases of celebrity contractions have replaced the gentle pleasure of checking sports results and daily gossip. After the financial crisis of 2008, we were repeatedly told we were ‘all in this together’, nothing is more true today. With our prime minister in hospital and countless household names displaying symptoms, we will all know of people affected. My sister and her whole family are emerging from contracting Coronavirus and their experience is ‘interesting’ to use a classic understatement (one laid low in a bad way for two weeks, one feeling like death for four days followed by a quick recovery and two with mild symptoms albeit very different in nature). None thankfully needed hospital treatment but all are untested and therefore outside of the statistics. In recognising that there are more important things to address, this is simply a brief report on how we, as a business, are experiencing this challenging environment with a few observations on what others are doing as well, whilst making a tentative attempt at commenting on the state of the market. |

Lockdown

On 23rd March, together with much of the country, we commenced our state of lockdown. For about a week prior to this we had had 50% of the team working remotely already. It was a few days later that the government confirmed that estate agencies and the like were not ‘essential businesses’ (no jokes please!). A meaningful part of our business is in build / design with the refurbishment / development of property for clients. We had seven active projects as of 23rd March, plus numerous smaller maintenance jobs. Two of the projects were due to be completed by the end of lockdown week with the owners due to move in that weekend. Frantic activity saw these jobs completed. All hands on deck, meant a husband and children were engaged as helpers at one house! The other projects are now unfortunately affected as social distancing is paramount and, barring a few trades like decoration, maintaining safe distances on site is just too difficult. While the Government’s directives on what is permissible are somewhat ambiguous, certain buildings and/or landlords, from the Grosvenor Estate to single share of freehold blocks, are introducing a prohibition on any works and restricting access to workmen for emergencies only.

On 23rd March, together with much of the country, we commenced our state of lockdown. For about a week prior to this we had had 50% of the team working remotely already. It was a few days later that the government confirmed that estate agencies and the like were not ‘essential businesses’ (no jokes please!). A meaningful part of our business is in build / design with the refurbishment / development of property for clients. We had seven active projects as of 23rd March, plus numerous smaller maintenance jobs. Two of the projects were due to be completed by the end of lockdown week with the owners due to move in that weekend. Frantic activity saw these jobs completed. All hands on deck, meant a husband and children were engaged as helpers at one house! The other projects are now unfortunately affected as social distancing is paramount and, barring a few trades like decoration, maintaining safe distances on site is just too difficult. While the Government’s directives on what is permissible are somewhat ambiguous, certain buildings and/or landlords, from the Grosvenor Estate to single share of freehold blocks, are introducing a prohibition on any works and restricting access to workmen for emergencies only.

Going remote

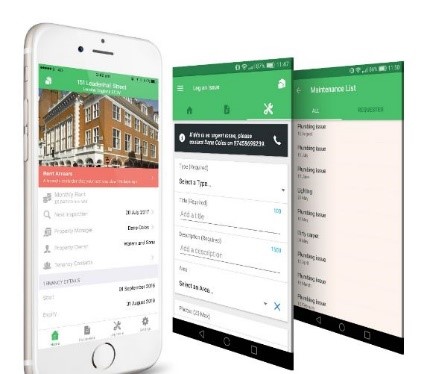

Around 18-20 months back we invested quite considerably in a new web-based property management program. This also runs our smaller projects and maintenance. In our mind this would not only allow for remote working (prescient though this was, a global pandemic was not part of our critical planning) but give access to tenants via an app to report faults, view agreements and see key documents. It is also a more effective tool for our landlords to receive and view statements, check on renewal dates etc. There were a few early teething problems inevitably but it has been overwhelmingly well received. It now feels like a gift from heaven as we sit in our kitchens WFH.

An industry works together

The estate agency world has really pulled together. Central London has always been a market that relied on interaction between agents and was very much relationship based. It is less ‘clubby’ than 10 years back, let alone 20 where it really was an ‘us and them’ game, hence the cold shoulder given to certain newcomers with sharp practices, but it is still fundamentally a business based on ethics and respect between agents.

A few online platforms were slow to recognise this (mentioning no names but they are the usual suspects for searching property online) and with many small agencies facing instant ruin, they initially made weak gestures in relation to their subscriptions. After a backlash, they have either suspended these altogether or offered discounts (some cheekily adding clauses of future exclusivity). LonRes, an agency-only subscription site which is widely used and hugely respected in central London, was quick to show support.

Inevitably much is being lauded with regards to video tours and as a buying agent we are being offered plenty of short movies to watch. Netflix still has the edge. These are indeed a genuine tool but, as with all online information, it’s not what you are told and can see but what you are not told or shown. The devil is always in the detail and property is no different.

Business not as usual

With the high streets shut down and viewings of property disallowed (or deemed non-essential), estate agents with no portfolio to manage are feeling somewhat excess to requirements. Savills, meanwhile, recently boasted that they had held an online auction and sold £18m of property. Impressive to a point but this pales into insignificance when comparing with the near £200m they exchanged on in the few days before last month’s budget on the back of the rumoured additional 3% stamp duty to be levied on foreign buyers. This turned out to be 2% and not applicable until April 2021. To help struggling businesses, the government has stepped in with salary guarantees, business rates holidays, VAT payments deferred, etc. It’s quite a bill and no doubt a great debate is brewing on the rights and wrongs of such largesse. Meanwhile words like furlough and social distancing are new additions to the lexicon that will forever be linked to a grim start to 2020.

With the high streets shut down and viewings of property disallowed (or deemed non-essential), estate agents with no portfolio to manage are feeling somewhat excess to requirements. Savills, meanwhile, recently boasted that they had held an online auction and sold £18m of property. Impressive to a point but this pales into insignificance when comparing with the near £200m they exchanged on in the few days before last month’s budget on the back of the rumoured additional 3% stamp duty to be levied on foreign buyers. This turned out to be 2% and not applicable until April 2021. To help struggling businesses, the government has stepped in with salary guarantees, business rates holidays, VAT payments deferred, etc. It’s quite a bill and no doubt a great debate is brewing on the rights and wrongs of such largesse. Meanwhile words like furlough and social distancing are new additions to the lexicon that will forever be linked to a grim start to 2020.

The world can turn on a sixpence

Way back in time, like February, things were looking good. We were enjoying the ‘Boris bounce’ and although no one thought the problems of the world had been erased simply on the back of one surprising election result, cautious optimism seemed to be the prevailing mood. Although the storm clouds in Wuhan were starting to spread, it wasn’t until early March when the world, from a UK perspective, changed.

In January/February we had agreed the purchase on more property than in the previous 12 months. One of our last completed developments that had to be let as a fallback from the fallout of the Brexit fiasco, was to be re-offered for sale at the same price as originally intended with considerable, and pleasantly surprising, interest from a number of buyers. We were about to embark on two refurbishments of long held investments as we eyed the opportunity for our clients to optimise an exit in a market starved of choice.

How different the world looks now. Some, but not all, of the agreed acquisitions proceeded. The development mentioned faces challenges in getting re-let, let alone sold, due to restrictions on viewings and the two refurbishments are proceeding with their specific challenges of social distancing.

There still remains a market

Trends are still being bucked, however. We were negotiating for two parties on a very high-end new scheme in Mayfair. The average purchase being close to £6,000psf. As COVID-19 took hold, both clients chose not to continue, yet in mid March it was announced that a buyer had exchanged on one of the penthouses at £8,000psf. This came on the back of a few other mega deals, including a £25m deal at One Kensington Gardens.

For our part, one of the acquisitions we exchanged on in early March completed two days after lockdown. We felt it was quite special and to prove our point we look likely to have let it this week despite lockdown. We also had a best offer competition on another plus we received a rental offer at £9,000 per week, again despite lockdown. Other lets are commencing as agreed. On the acquisition side, we are currently negotiating the purchase of a probate sale which we expect to agree at around 22.5% off its original, slightly ambitious, asking price set back in early December.

Meanwhile, close to 25% of our tenants are self isolating in their home countries. To date just one tenant has informed us that they are no longer employed. Generally the portfolio is running as normal, allowing for the odd loose door or wonky tap needing to be diarised for a fix ‘later’.

What comes next?

No one knows how the next weeks, and possibly months, will play out. There will be an end and with it an opportunity, for those in the position to do so, to capitalise on.

As of today, residential property prices are effectively frozen. The commercial sector however is very different, often owned through public listings and pension funds, and it has been noticeably affected as stocks and shares have tumbled leading to urgent selling. Retail and hotel sectors have been the hardest hit. Some funds have had to suspend their trading and stop all redemptions. Dividend payments may too be suspended.

Residential will not be unaffected and the wider economic fallout will determine to what extent the effects are. However, I suspect many direct investors took comfort in their tangible, illiquid assets which continue to offer them a 2% or so market value net yield. As stocks indices around the world fell 20-25% and some companies lost well over 50% of their value, physical property for some provided the ballast in very stormy seas.

With base rates now next to zero, those who find themselves owning genuine quality assets can look to yields that start to have a real draw. Overseas investors will find the currency play enticing once more and there will undoubtedly be ‘sellers in need’ and possibly not just those owning the mediocre and poor performing. The question is perhaps less about the opportunities that are around the corner, but more about how many opportunists are gathering.

Interesting times ahead.

All of us at Obbard wish you, your family and loved ones good health and happiness.

You can see some of our latest design and build projects at www.obespoke.co.uk

If you would like more information,

do get in touch on +44 (0)20 7349 8920 info@obbard.co.uk

| NOTE: The opinions expressed are solely those of the author and are not intended to offer any advice, formal or otherwise, on the nature of property investment. All the information is provided in good faith for general interest only. Recipients who have not formally appointed Obbard are advised to seek independent professional advice and to satisfy themselves on the state of the market, the opportunities and risks. |