To-morrow, to-morrow, to-morrow

NEWSLETTER SPRING 2019 |

|

To-morrow, to-morrow, to-morrow Rather like the quote above from the Scottish play that can’t be mentioned, there is a political situation going on which it is no longer acceptable to be mentioned in polite company. Having planned on putting pen to paper in early March for my market update, I feel horribly naïve that I assumed we would know our future by now. The other nagging worry is that by the time I have finished typing this sentence, something else pivotal or dramatic will have happened, whether this be a resignation, a new party, another vote etc. etc. However, life, to a point, goes on and while the politicians enjoy standing around in their circle of self-destruction, there is a property market to report on. |

Down but far from out

We are some four and half years on from the market peak for the prime London residential

market. Statistics tend to provide a somewhat simplistic overview, equally they are as likely to be used strategically to make a particular case. I dislike using generalisations in such a nuanced market but you simply can’t avoid them. So, in general, prime London prices are somewhere around 15% to 20% off their peak in nominal terms. There are quite significant variations however, with the lower value ranges holding up much better than the upper values. Anecdotal evidence of houses on Avenue Road, NW8, for example, can show prices off 50% or more. But as London’s newly crowned ‘most expensive Avenue’ (supplanting Hampstead’s Bishop’s Avenue) the average house is well north of £10m. Meanwhile a quality one bedroom flat around £500,000 is as tough to find as it ever was, and is likely to have followed the national UK property index which has shown consistent, albeit slender, growth over the past 5 years.

There is however a change in the air, the broad UK housing market looks to be stalling and may dip in to negative territory this year. This is despite the all important ingredient for house price growth returning last year, that of real wage growth. Meanwhile at the other end, the super prime market (£25m +) has suddenly returned to the fore with some eye watering deals over the past 6-8 months. Back in the real world we have a challenged market which is just holding up on the back of need based, real demand.

Many agents report high levels of enquiries, viewings etc. The reality is that many buyers are looking but waiting. Meanwhile, sellers too are listing and waiting. Each expects the market to do what they want it to do. Putting these groups aside, there are sellers and buyers in need of making decisions and when the two shall meet, a transaction follows. This market can perhaps be characterised as a more ‘normal’ market, in so much that the demand is being driven by basic needs to transact.

The last 25 years may not be an indicator for the next 25

In 1994 interest rates were around 6%. They are currently 0.75% having risen from 0.25% which we have often been told was a 350 year low. While 6% may take a long time to return, it doesn’t bear thinking about the 14% 3-4 years previously, we are likely set on a different path for interest rates over the next decade or so. This together with changes to the tax system that impacts on investments and transactions, is likely to lead to an ‘old fashioned’ view of property which was as a safe and secure, long term investment. The days of high leverage and quick riches are unlikely to return any time soon.

On reflection, the traditional prime London residential investment market peaked in 2006 as yields sank to 5% and borrowing costs stood at around 6%. We then had the dizzy days of 100% loans and of course know what followed. QE then came to the rescue and with barely missing a heartbeat other than a few months between late 2008 and early 2009, the market took off at pace returning double digit capital gains. George Osborne set out to cool, then spoil this party some 5 years back. A year or so ago, we were seeing a return to the inverse yield/borrowing ratio, particularly due to the increased costs of acquiring property due to Stamp Duty hikes. Today yields in prime central London are likely to start with a 3 and borrowing costs with a 2. The margin is narrow but we are seeing pressure on rents to rise and the outlook is favouring the investor in this regard. Looking slightly beyond prime, 4% or even 5% gross yields are achievable with demand putting pressure on rents.

Buyers, you hold the cards

With all the uncertainty around, the time is well in favour of the buyer. If you take a view, as we do, that the London property story is as appealing as it ever was albeit with a longer hold projection, then buying in this climate has real attraction. In reference to comments earlier, the key is to find sellers in need. Examples would be probate sales, properties where buyers have pulled out of a sale leaving a seller compromised, relocators (expats returning overseas, down sizers), portfolio sellers where cash needs to be realised. It sounds easy but they are not that easy to dig up. When you come across them, the discount on those heady days back in 2014, looks very juicy.

NEWS FROM THE FRONT |

|

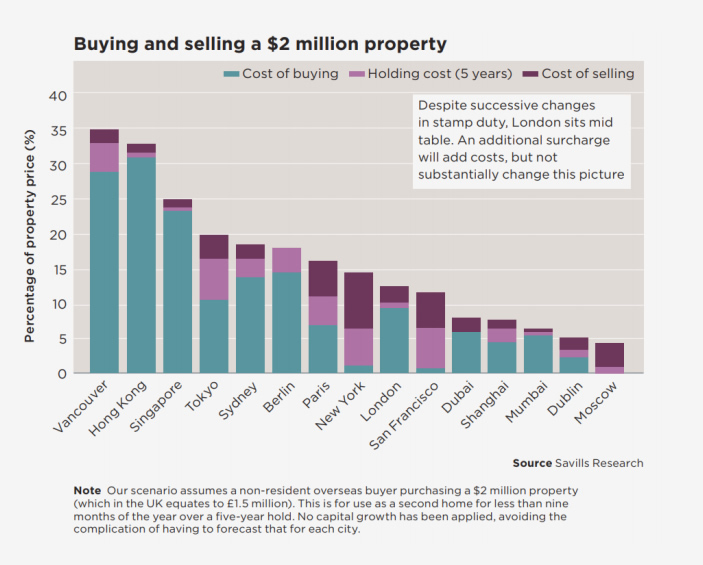

We tend to agonise and remonstrate over the changes to our property taxation over the past 5 years. Particularly those of us who remember 1% stamp duty for all, no CGT for overseas owners and everything you could think of to be offset against your rental income. However, as many know from other parts of the world, residential property prices have become a hot political potato. The graph opposite however was interesting to see when looking where the UK sat for global investors. |

|

Some recent big deals

Big deals are hardly a litmus test on the market as a whole but the number of high profile single home deals in the past 3 months or so, at the very top end, has been a surprise for many.

|

|

OUR NEWS |

Obespoke

Our team at Obespoke keeps growing. Our vehicles are becoming a regular sight around central London. We have a good flow of projects and seem to have pricked the interest of quite a few Houzz and Instagram followers! We are always here if you or friends want a quote or a design discussion.

|

Investment tip of the month With mortgage interest no longer able to be offset, many landlords are finding themselves ‘writing out cheques’ to HMRC. A number of our clients have looked at how to get around this. One way is to invest in improvements. This is a legitimate off-settable expense and suited to properties where there is a genuine need to upgrade and their overall UK income takes them into the higher tax bracket. Typically this would be planned between tenancies but in a number of occasions we have carried out a total bathroom or kitchen upgrade while rent is still being paid. This works with tenants who spend long periods abroad, a not uncommon occurrence in the higher value rentals. Our first client had a potential £23,000 tax bill and we upgraded two bathrooms, spread over two tax years and he paid HMRC just a couple of thousand. |

You can see some of our latest design and build projects at www.obespoke.co.uk

If you would like more information,

do get in touch on +44 (0)20 7349 8920 info@obbard.co.uk

| NOTE: The opinions expressed are solely those of the author and are not intended to offer any advice, formal or otherwise, on the nature of property investment. All the information is provided in good faith for general interest only. Recipients who have not formally appointed Obbard are advised to seek independent professional advice and to satisfy themselves on the state of the market, the opportunities and risks. |